You can become the winner of Dream11 by including these players in your fantasy team in the CSK vs RCB match.

Players who are fond of fantasy games may also be preparing strategies for their Dream11 team.

CSK vs RCB: Match Details

Match: Chennai Super Kings vs Royal Challengers Bangalore, 1st Match

Match date: 22 March 2024

Time: 8 pm Indian time

Location: Chennai

CSK vs RCB pitch report

If we talk about Chennai pitch, it is generally slow and spinners get help here. We can say that Chepauk has a slow turner wicket. In such a situation, the magic of spinners can be seen here. Both the teams have good spinners. CSK has a big weapon in the form of Ravindra Jadeja and he also has a lot of experience playing on this pitch. In such a situation, he can perform well in this match. Apart from this, RCB has Karn Sharma, who is an expert in rotating the ball.CSK vs RCB Fantasy Tips

The rivalry between Chennai Super Kings and Royal Challengers Bangalore is quite old. Chennai defeated RCB in the 2011 IPL final. Both teams have match-winning players available. Players like Ruturaj Gaikwad, Darryl Mitchell, Ravindra Jadeja, Rachin Ravindra and Mahish Tikshina can be very important in CSK. If you include these players in your dream eleven team then you can get a lot of benefit.At the same time, RCB also has many legends. Players like Virat Kohli, Faf du Plessis, Glenn Maxwell, Cameron Green and Mohammed Siraj can lead their team to victory. If you select these players then you can get benefit in Dream XI.

CSK vs RCB: Probable playing eleven

Chennai Super Kings: Ruturaj Gaikwad, Rachin Ravindra, Ajinkya Rahane, Shivam Dubey, Daryl Mitchell, Ravindra Jadeja, MS Dhoni (captain and wicketkeeper), Shardul Thakur, Mahesh Tikshina, Deepak Chahar, Mustafizur Rahman.

Royal Challengers Bangalore: Faf du Plessis (captain), Virat Kohli, Glenn Maxwell, Rajat Patidar, Cameron Green, Mahipal Lomror, Dinesh Karthik (wicketkeeper), Karn Sharma, Akash Deep, Mohammed Siraj, Lockie Ferguson.Wicketkeeper: Dinesh Karthik

Batsmen: Virat Kohli, Faf du Plessis, Ruturaj Gaikwad, Darryl Mitchell.

All-rounder: Ravindra Jadeja, Glenn Maxwell, Cameron Green, Rachin Ravindra.

Bowlers: Shardul Thakur, Mahesh Tikshna.

Captain's first choice: Virat Kohli || Captain second choice: Ruturaj Gaikwad

Vice-captain first choice: Glenn Maxwell || Vice-captain second choice: Darryl Mitchell

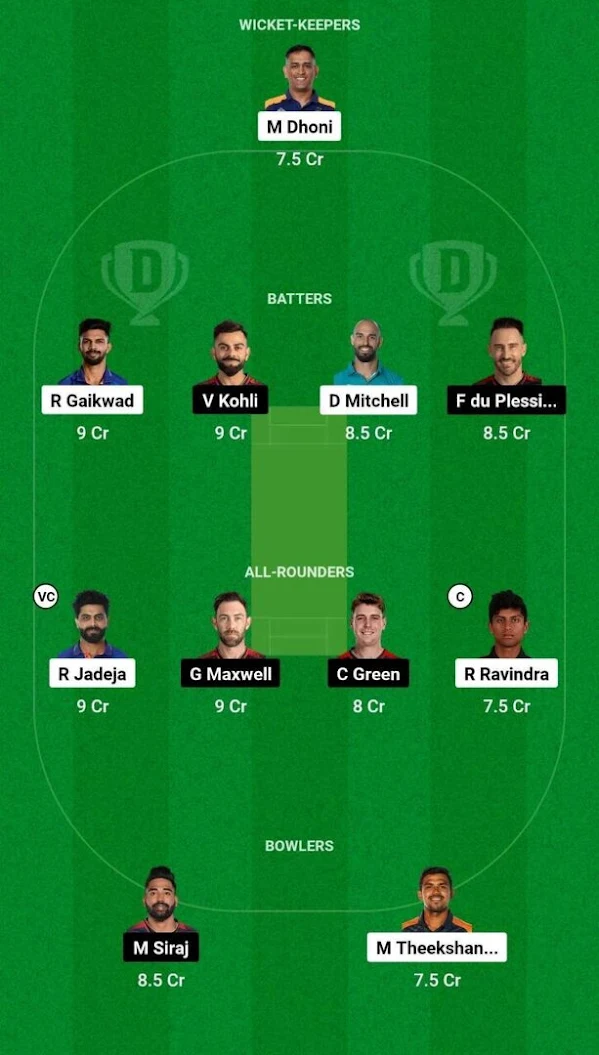

CSK vs RCB Match Dream11 (Team 2):

Wicketkeeper: MS Dhoni

Batsmen: Virat Kohli, Faf du Plessis, Ruturaj Gaikwad, Darryl Mitchell.

All-rounder: Ravindra Jadeja, Glenn Maxwell, Cameron Green, Rachin Ravindra.

Bowlers: Mohammad Siraj, Mahish Tikshna.

Captain's first choice: Rachin Ravindra || Captain second choice: Faf du Plessis

Vice-captain first choice: Ravindra Jadeja || Vice-captain second choice: Cameron Green

CSK vs RCB: Dream 11 Prediction – Who will win this match?

Chennai Super Kings team will play the match in their home ground and because of this they can get a lot of benefit. He has a lot of experience of playing in the conditions here and CSK will also get a lot of support from the fans. In such a situation, Chennai has more chances of winning this match.